Hello everybody!

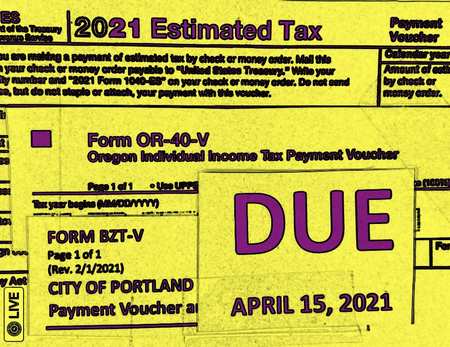

Just a reminder that 2021 1st quarter estimates are still due by 4-15-21

Yes, IRS & Oregon have both extended the 2020 individual tax filing deadline (for forms 1040/40) by one month, to May 17, 2021. But NOT the estimates...

1ST QUARTER 2021 FEDERAL & OREGON ESTIMATES ARE STILL DUE BY APRIL 15, 2021! City of Portland/Mult Co too, if you are required to pay those.

Obviously, that causes problems for those who have not calculated & filed their 2020 income taxes by April 15th. So, what amount should you pay to avoid penalties?

Here's some direction...

If I've already prepared your 2020 individual income tax returns... there is a schedule of 2021 estimates in your tax letter, if you asked me to help prepare estimates for you. Please remember to pay the 1st one by 4-15-21. Do that online or if you mail the payment & vouchers (1040-ES & OR-40V), i recommend that you mail them using "certified mail" in order to prove timely payment.

If you have not provided me complete 2020 tax information by now, with all questions answered... I cannot tell you what to pay by April 15, 2021, since i don't have the information to calculate accurate 2021 estimates or even a safe harbor amount to pay. Please see my tax letter in the "organizer package" that was mailed to you last December, indicating my April 1st deadline for complete information. That cut-off date is necessary, since professional tax preparation just can't be rushed for clients in the last 2 weeks before a tax deadline.

I suggest that you use the information below to calculate your 2021 estimates & then overpay that 1st estimate by at least 25%, and peruse the links below.

The following links access general information on estimated taxes, a 2021 IRS and Oregon tax calculator, forms 1040-ES, OR-40V & the new City BZTV, and electronic filing.

I am happy to talk you through this! I am available for consultation by email, phone, or even Zoom. Just email me at cpa@garlandtaylor.com if you need that extra help. I can also email you blank forms for YOUR use and a letter of instruction, at your request. Garland

Garland Taylor CPA, Pres. GARLAND TAYLOR CPA, PC

I N T E R N A L R E V E N U E S E R V I C E

Estimated Taxes | Internal Revenue Service (irs.gov)

Tax Withholding Estimator | Internal Revenue Service (irs.gov)

https://www.irs.gov/pub/irs-pdf/f1040es.pdf

Payments | Internal Revenue Service (irs.gov)

O R E G O N

2021 Publication OR-ESTIMATE, Oregon Estimated Income Tax Instructions, 150-101-026

State of Oregon: Individuals - Tax calculator

Form OR-40-V, Oregon Individual Income Tax Payment Voucher, 150-101-172

State of Oregon: Oregon Department of Revenue - Payments

C I T Y O F P O R T L A N D (business only)

Tax Year 2020 Due Date Change | Portland.gov