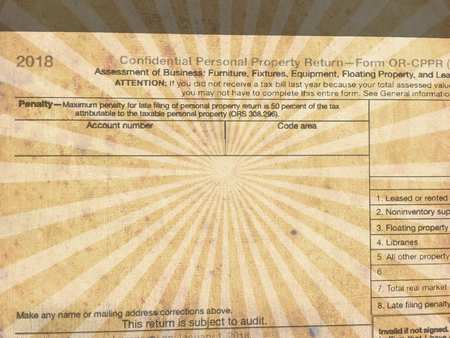

If you operate a business in the State of Oregon you must file an annual return (with your local county tax assessor) listing the equipment used to run your business.

"By Oregon law business personal property is taxable in the County where it is located as of January 1. Each individual, partnership, firm, or corporation that has taxable business personal property must file an annual business personal property return to the County bby March 15th."

Please see my year-end tax planning blogs & tax organizer advising you of this requirement each year. THIS REPORT IS DUE IN THE ASSESSORS OFFICE BY 3-15-18.

Here's a link to the Multnomah & County form & instructions. If you have property located in another Oregon county, you should file with that Counties Tax Assessor's Office.

https://multco.us/assessment-taxation/business-personal-property-assessment

This simple asset based report is NOT part of my CPA firms' normal income tax services, but if you need help or direction, please contact me in writing asap. However, this required report should be easy to complete on your own. Just a quick reminder!

Thanks! Garland